How COVID-19 is changing the fashion world.

Apparel companies adjust as coronavirus impacts retail.

The fashion industry is in the midst of a hyperspeed evolution.

The novel coronavirus pandemic upended nearly every part of the industry in a matter of weeks, as people followed shelter-in-place orders around the globe — with little desire or need to wear much beyond casual clothing.

With no guidebook for this unprecedented challenge, many retailers have filed for bankruptcy. Others are seizing opportunities to transform their business-as-usual habits and find new ways of reaching and exciting their customers. They are rethinking the supply chains and processes through which clothing gets made, as well as shifting sales to e-commerce platforms; focusing on what’s now known as “work-from-home” wear; and adjusting store layouts and procedures.

“We’re going to evolve into what everyone knows is some sort of new normal,” said Pete Nordstrom, President of Nordstrom, in an April panel hosted by Vogue. “We’re going to have to be flexible.”

Tailored supply chains

Inventory was so backed up due to the pandemic that surplus clothing — some of which flooded ports when China re-opened its factories — is creating short-term demand for industrial space.

“As ships arrived with inventory that was not ultimately heading to retail, occupiers were looking for additional short-term space to house it,” says Rich Thompson, International Director, Supply Chain & Logistics Solutions, JLL, who is based in the U.S.

Retailers have inventory full of spring wear that couldn’t be sold during the lockdowns, he says, and it is uncertain what demand will be for the remainder of 2020.

The apparel industry, globally, could see revenue contract by 27 to 30% this year over last, according to a predictive joint report from Business of Fashion and McKinsey & Company.

“This is the lost season — we likely won’t have the typical big ‘back to school’ retail season — so adjustments will need to be made,” Thompson says.

But the mismatch issue pre-existed the pandemic, and some experts say the crisis could help the whole fashion ecosystem evolve to be nimbler.

Legacy systems in the fashion industry have long required orders 9 to 12 months before a season starts.

The result is often a mismatch between what store buyers believe customers want and what customers actually take home, said Vittorio Radice, who spoke during the Vogue panel and is a retail veteran at the Italian department store La Rinascente.

“When there’s too much stock, (you) have to discount incredibly in order to get rid of things, and then buy the new season again,” Radice said. “If you keep the same…mechanisms, you end up with (the same) problem.”

More packages at the door than ever before: check

Fashion retailers are rapidly shifting to e-commerce. Online sales skyrocketed following the March closures of brick-and-mortar stores in the U.S., with a 45% increase of sales through online channels by the end of April as in-store purchases plummeted, according to data from analysis firm Commerce Signals.

Even as cities begin to reopen around the world, retailers are focused on increasing online sales, expecting consumer behavior to outlast the immediate crisis, says David Zoba, Chairman, Global Retail Leasing Board, JLL, who is based in the U.S. Many companies with a limited online presence have raced to expand it.

Retailers that already had e-commerce traction are ahead of the curve, and many are increasing that reach through community-building virtual experiences, he says. During the closures in China, for example, Nike’s e-commerce sales increased as the company offered workout-from-home content on its fitness app. There was an 80% increase in users in the first quarter, which fueled a 30% increase in digital sales.

Many fashion companies — even luxury brands — are offering deep online discounts to move as much stock as possible, Zoba says.

“The hope is to avoid repeating what happened in the wake of the 2008 financial crisis, when there were steep discounts at physical stores and retailers faced a slow rebound from a public that got used to bargains,” Zoba says. “But the discounts are certainly taking off online.”

Meanwhile, fashion companies with complementary digital and physical channels will benefit as shoppers pick up online orders from brick and mortar locations, Nordstrom said during the Vogue panel.

“People have pivoted over the last several years…you have the online and the stores working together and really leveraging those assets to be a seamless experience,” he said.

Trending: work-from-home wear

The pandemic, almost overnight, elevated the need for comfortable leisure wear, as people work, live and play from their homes.

Athleisure has been hot for a while, but it’s only a branch of this larger evolution, Zoba says.

“Work-from-home is a category of merchandise that never existed before and is going to persist for quite a while,” Zoba says.

Lululemon, already a dominant presence in the athleisure market, is seeing sales take off from its years of footwork expanding into loungewear. Betabrand, an online retailer that years ago began blanketing social media with its “Dress Pant Yoga Pant” pitches, hosted a “Work From Home” digital runway show early on in the pandemic and has seen sales steadily pick up.

“Established athleisure brands that already branched out into loungewear before the pandemic are seeing wins, while other brands are launching lines,” Zoba says.

Changes to physical stores

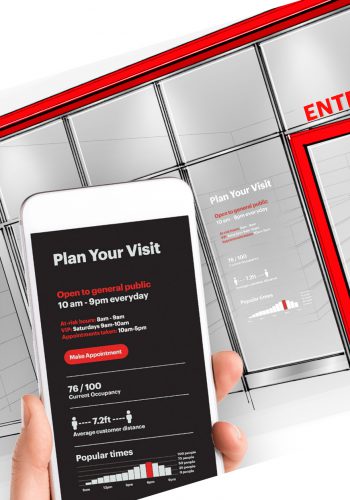

It takes a combination of messaging, as well as visible displays of safety precautions — such as masked salespeople; available hand sanitizer; and signs detailing frequent cleanings, physical distancing rules and return policies — to successfully reopen a store following a lockdown, says Michael Ball, Director, Retail, JLL, who is based in Shanghai.

“Safety will remain important to a public with a heightened consciousness around germs,” he says.

Simon Property Group, which reopened 49 malls in early May, began frequent sanitizations of high-touch areas such as food court tables and escalator rails, while offering shoppers free temperature checks, masks and hand sanitizer upon request.

Such assurances appear to be paying off in China. There, 60 to 70% of people expect to be back to their pre-pandemic shopping habits, and 10% plan on shopping more, according to a McKinsey & Co. survey. The same thing is happening in markets that have opened in Europe.

“What we are seeing in Italy and other countries in Europe is that consumers are engaging and shopping well in stores that are clearly communicating their health and safety guidelines,” says Charlotte Elstob, Vice President, International Retail, JLL. “For example, Apple wrote a letter to all consumers about how their handling reopening, and Gucci is handing out gloves and masks to all shoppers.”

Customer intimacy

Clothing brands are taking active steps to connect more deeply with their customer base.

“Retailers who acknowledge the universal uncertainties and fears, rather than focusing primarily on pushing sales, can keep and build relationships,” says Elstob. “Communications that comfort customers will keep them connected to their favorite brands, even if they are cautious with spending now.”

Marcus Wainwright, founder of Rag & Bone, signaled empathy in an open letter emailed to customers, conveying that the New York-based company was concerned first and foremost with the health of their employees and customers. The company quickly changed how it how does business, applying unprecedented deep discounts online and redirecting its U.S.-based manufacturers to make masks, sold with a per-item donation percentage given to a New York-based food charity.

“New York and the world will come back from this,” Wainwright wrote. “Hopefully, we can all take this opportunity to evolve and come out of this wiser and more human than we went into it.”

As consumers begin to re-enter retail, are you prepared for what’s ahead?

Contact us to help you reimagine what comes next.

Image: Jared Siskin / Getty Images Entertainment